Biden White House slams cryptocurrencies, says they’re not valid assets

03/27/2023 / By Ethan Huff

The cryptocurrency community is fuming mad about a new 35-page report from the Biden White House that is “seemingly aimed at debunking the merits of crypto assets,” to quote Coin Telegraph‘s Felix Ng.

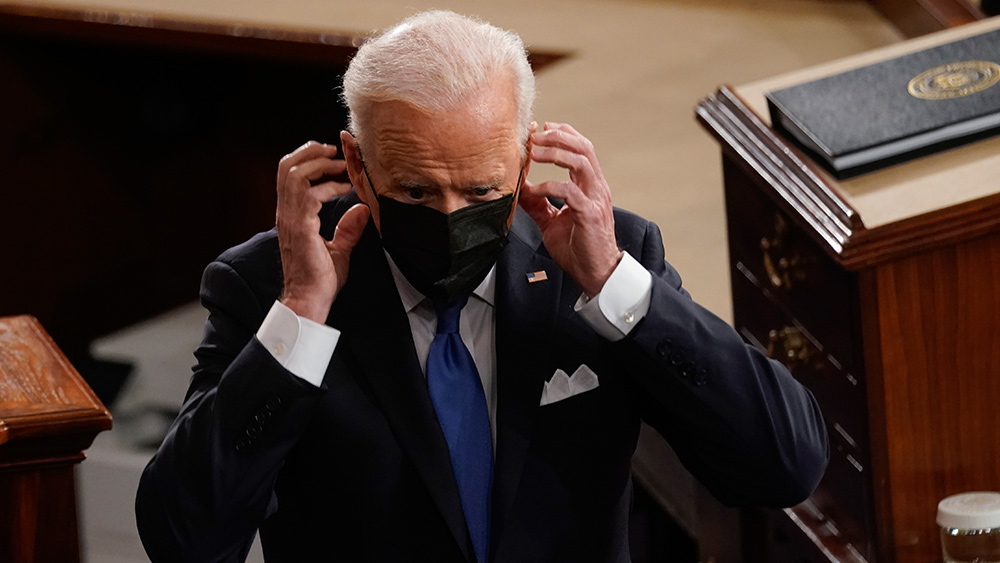

Calling the report “crypto FUD,” crypto holders and traders say the Joe Biden regime is ill-informed about crypto’s true utility, which the report claims is nonexistent.

For the first time since its first issue was released in 1950, the latest version of The Economic Report of the President, released on March 20, includes an entire section on digital assets that blasts them as inferior to the fiat dollars issued by the private Federal Reserve.

“15% of the annual White House Economic Report is devoted to crypto FUD,” tweeted Fred Ehrsam, co-founder of the digital asset investment firm Paradigm.

(Related: Many cryptos are a scam: beware.)

Avoid crypto and stick with Federal Reserve fiat notes, Biden White House urges American public

The 35 pages of the report that are devoted to crypto aim to debunk the “Perceived Appeal of Crypto Assets” by steering people back towards centralized finance in the form of the Federal Reserve’s upcoming new FedNow payment system, as well as its central bank digital currencies (CBDC).

The biggest criticism of crypto in the report deals with the failure of some of them to actually deliver on their “touted” benefits. This includes things like failing to improve their payment systems and failing to create useful mechanisms through which value and intellectual property can be transferred.

“Instead, their innovation has been mostly about creating artificial scarcity in order to support crypto assets’ prices – and many of them have no fundamental value,” the report states.

Another aspect of crypto addressed in the report has to do with the failure of some cryptocurrencies to function as “sovereign” money. The U.S. dollar, which is backed by nothing and endlessly and abusively printed, is supposedly a sovereign form of money with which crypto cannot compete, according to the Biden regime.

“So far, crypto assets have brought none of these benefits,” Biden’s people claim. “Meanwhile, the costs generated by several of their aspects – such as those for consumers, the physical environment, and the financial system – are not only substantial but are also being accrued in the present.”

Even so-called “stablecoins” are too risky and do not function properly as a “fast payment” instrument, the report goes on to state. And as for the decentralization aspect, the Biden White House insists that this is just a myth, and that blockchain-based applications are neither decentralized nor trustless.

“We urge the Biden administration to consider how it will be remembered: as a leader of profound innovation or a roadblock to a global tech revolution,” responded Blockchain Association CEO Kristin Smith, who called the report “disappointing,” adding that some in government seem to be “increasingly allergic” to the growing crypto industry.

The report comes just weeks after the collapse of numerous banks, including Silicon Valley Bank (SVB) and Signature Bank, both of which were involved with the crypto industry. It also comes on the heels of the collapse of FTX, which was a fraudulent crypto Ponzi scheme.

“Some pretty shocking excerpts … on crypto & U.S. CBDC from this week’s 513 page Economic Report of the President released from the US,” tweeted Dan Reecer, chief growth officer at decentralized finance platform Acala Network. “Things are looking bleak for US competitiveness, economic freedom, and privacy if this continues.”

“Just days after Operation Choke Point 2.0 was executed on US-based crypto-friendly banks, The Economic Report of the President was released yesterday, including an attack on crypto and an obvious early warning of an upcoming U.S. CBDC.”

More related news can be found at DollarDemise.com.

Sources for this article include:

Submit a correction >>

Tagged Under:

assets, Biden, big government, chaos, crypto, cryptocollapse, cryptocurrency, currency crash, deception, deep state, dollar demise, economic freedom, finance riot, inflation, Joe Biden, market crash, money supply, panic, report, risk, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2021 DollarDemise.com

All content posted on this site is protected under Free Speech. DollarDemise.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. DollarDemise.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.