The Jim Price Show: Jerome Powell “pranked” into divulging Fed’s planned rate hikes – Brighteon.TV

05/04/2023 / By Kevin Hughes

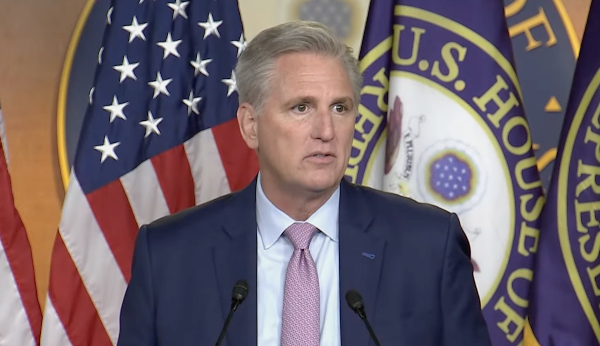

Jerome Powell, chairman of the Federal Reserve, was pranked into disclosing the central bank’s planned interest rate increases.

Jim Price expounded on this during the April 27 episode of “The Jim Price Show” on Brighteon.TV. According to the host, Powell was deceived by two podcasters that made him believe that Ukrainian President Volodymyr Zelensky was on the other side of the call.

The program host also mentioned an article from the Gateway Pundit about the prank. According to the piece, two notorious Russian pranksters with the aliases “Vovan” and “Lexus” got the Fed chairman to make a series of shocking admissions during the phone call. Powell claimed that the central bank will hike interest rates two more times, and even joked about having a printing press in the basement of his home.

“That’s the part where you’re getting pranked … or whatever. That’s a problem sometimes when the fact is that you actually tell the truth to the person that’s pranking you,” Price said. “Well, you’re not just made a fool of, but then you’ve also got yourself [in] a bit of a bear trap.”

According to Price, if someone isn’t telling the truth all the time, then that means they can get caught in a lie. A person who consistently lies will eventually normalize the habit, he added.

Rate hikes will lead to the US economy’s “controlled crash”

A spokesman for the Fed confirmed that Powell did participate in a conversation last January with someone who misrepresented themselves as Zelensky. The spokesman clarified, however, that it was a friendly exchange that took place in the context of America’s standing in support of the Ukrainian people. No sensitive or confidential information was discussed, the Fed spokesman reassured.

But Price remarked what he didn’t like in the conversation was Powell saying that he was going to go ahead and raise the rates a couple more times. This, he warned, will continue to slow down several American markets.

According to Price, the federal government is trying to do a controlled crash landing of the economy and Americans know their government wants to exchange the U.S. currency with a central bank digital currency (CBDC). (Related: Federal Reserve set to introduce privacy-crushing digital currency that can be ‘controlled’ and ‘programmed’ by government bureaucrats.)

“This plan has been going on for at least two years when they went ahead and allowed the central bank to be able to go clear down into the bank account of Americans,” Price said. “They have full access to every individual bank account unless that person is part of a credit union-type bank.”

Price isn’t sure if the credit unions have gotten an agreement with the central digital bank or a central bank with a CBDC, but he knows that the central bank has allowed big banks like Wells Fargo and Bank of America to have access to social credit scores that dictate whether a person’s money is actually worth anything or not.

Follow Collapse.news for more news about the impending collapse of the American economy.

Watch the April 27 episode of “The Jim Price Show” below. “The Jim Price Show” airs every weekday at 9-9:30 p.m. on Brighteon.TV.

More related stories:

Fed interest rate hikes make living in overpriced America even MORE expensive.

Federal Reserve expected to raise interest rates earlier than expected due to rapid inflation.

Sources include:

Submit a correction >>

Tagged Under:

big government, Brighteon.tv, bubble, CBDC, central banks, collapse, conspiracy, debt collapse, deception, economic collapse, economic riot, faked, Federal Reserve, finance riot, inflation, Jerome Powell, Jim Price, market crash, money supply, pranked, rate hikes, risk, The Jim Price Show

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2021 DollarDemise.com

All content posted on this site is protected under Free Speech. DollarDemise.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. DollarDemise.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.