Dozens of KFC restaurants across Midwest CLOSE SUDDENLY – Is EYM Group (Pizza Hut, Burger King) struggling to survive?

09/03/2024 / By Ethan Huff

Hundreds of employees were let go abruptly after dozens of KFC restaurant locations across Illinois, Indiana and Wisconsin closed suddenly this past week.

As many as 25 KFC restaurants owned by fast food franchisee EYM Chicken are now empty retail shells, but parent company EYM Group, which owns other fast-food chains like Pizza Hut, Burger King, Denny’s and Panera Bread, is not yet indicating the reason for the closures.

EYM Group has been struggling for years, it turns out. EYM Pizza filed for Chapter 11 bankruptcy protection after closing more than a dozen Pizza Hut locations in Indiana and Ohio.

WKOW 27 News reported that KFC locations in Reedsburg, Janesville, Beloit, Stoughton and Watertown are among the many closures there, which began on August 18 and will continue through August 31.

Back in March, KFC filed its franchise disclosure documents showing that it owns 47 restaurant locations across the U.S. Based on this sudden closure of 25 stores, this means the majority of EYM Chicken’s franchise locations will be closed before September begins.

“The decision to close a restaurant is always difficult for both the franchisee and the brand,” a spokesperson for KFC said. “We appreciate the patronage of our loyal guests.”

Before it decided to close a spate of Pizza Hut locations earlier this year, EYM Group was in a major court dispute with Yum Brands, KFC’s parent company. Pizza Hut sued the franchisee for not paying its royalties on time, and EYM accused Yum Brands of falling behind its competitors in technology and business practices.

(Related: Paul Craig Roberts believes that a massive financial collapse is coming that will destroy everyone’s assets.)

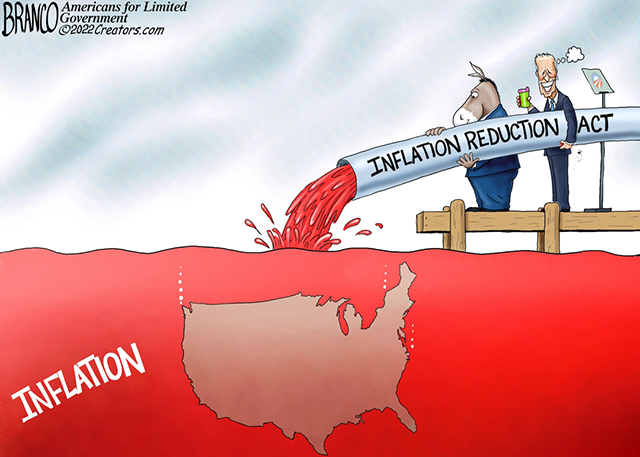

U.S. retail, restaurant sectors collapsing as inflation soars

These fast-food closures are just a drop in the bucket as America’s entire retail sector is in the throes of an implosion. Inflation is sky-high and still rising while costs are exceeding what businesses can afford to pay in order to stay afloat.

Food and labor costs are simply too much for the market to bear, which is leading to stores and brands cutting way back. This is creating a retail apocalypse that will eventually result in a commercial real estate (CRE) industry collapse.

Earlier this month, Italian chain Buca di Beppo filed for bankruptcy just a few days after it abruptly and out of nowhere shut down 13 of its lowest performing locations across the U.S.

The company said it closed certain locations because they were “unable to recover from the damage caused by the pandemic and other market pressures.”

Back in June, a Subway franchisee also filed for Chapter 11 bankruptcy protection. Some 48 different Subway locations are now at risk of closure in the coming days.

“Prices have skyrocketed while quality and quantity have declined,” one commenter wrote about the sad state of the U.S. fast-food industry these days. “Why bother going out except for special occasions?”

“Those states are economically depressed,” wrote another. “There is no growth other than welfare, stock market retirees, and government retirees. Lots of retirees, period.”

“As long as wealth can be printed, life is good. However, for businesses trying to survive without access to free wealth printing, the economic landscape is very difficult.”

Another wrote that food prices even at traditionally “cheap” fast-food chains like KFC are now so high that it simply is not worth eating there for most people anymore.

“During the pandemic, consumers were forced to do more home cooking,” another said. “The post-pandemic inflation made it easy to pass up spending money on fast food. We’ll survive with fewer McDonald’s and KFCs.”

America’s retail sector is struggling as the economy falters. Learn more at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

bubble, collapse, debt bomb, debt collapse, economic riot, economy, EYM Group, fast food, finance riot, food collapse, food supply, inflation, KFC, market crash, money supply, pensions, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2021 DollarDemise.com

All content posted on this site is protected under Free Speech. DollarDemise.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. DollarDemise.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.