DEDOLLARIZATION IN MOTION: Egypt moves against U.S. dollar, seeks trade settlements with BRICS states

02/19/2024 / By Richard Brown

Egypt is actively pursuing negotiations to decrease reliance on the U.S. dollar for trade settlements with other BRICS states, according to the country’s Ministry of Foreign Affairs.

The decision to embrace national currencies is driven by the need to counteract rising costs associated with using foreign currencies due to global inflation.

Ragy El Etreby, Egypt’s newly appointed ambassador to BRICS and assistant foreign minister for international and regional economic affairs, emphasized the importance of this strategic shift. This announcement is a significant step in the ongoing process of de-dollarization within the BRICS group.

The coalition, originally consisting of Brazil, Russia, India, China and South Africa, expanded this year to include five new members, including Egypt, reflecting a collective effort to reduce dependence on the U.S. dollar in international trade. (Related: BRICS and EAEU trade blocs are accelerating the demise of the dollar.)

Egypt’s trade turnover with BRICS members from 2022 to 2023 reached an impressive $46.673 billion, representing over a third of the country’s total foreign trade and highlighting the economic significance of its engagement with BRICS.

The global trend towards using national currencies in trade gained momentum, particularly after Russia faced isolation from the Western financial system in 2022, prompting a reassessment of reliance on the US dollar.

BRICS countries are actively promoting the use of their respective national currencies in mutual trade transactions, signaling a shared commitment to reducing dependency on the U.S. dollar.

Additionally, there are indications that the BRICS nations are considering the introduction of a new single trade currency, with discussions on this topic possibly taking place at the upcoming summit in August.

Expanded BRICS capable of challenging U.S. dollar even without introducing a new currency

While this proposed currency is still in the developmental stage, some Western officials acknowledge that the expanded BRICS, which now includes not only Egypt but also Saudi Arabia, Iran, Ethiopia and the United Arab Emirates, possesses significant economic influence capable of challenging the dominance of the U.S. dollar, even without introducing a new currency.

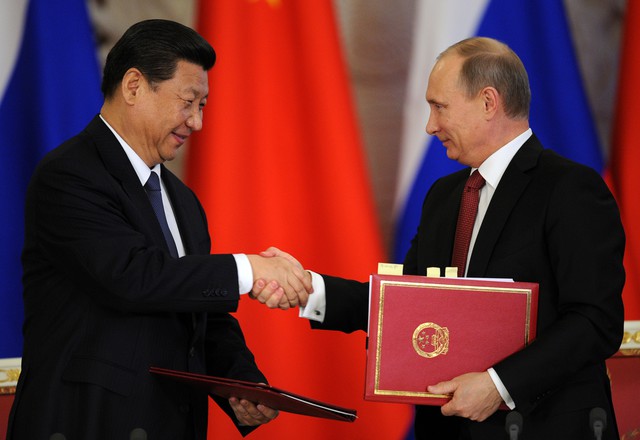

Last August, Russian President Vladimir Putin stated that the process of de-dollarization is gaining momentum in a virtual address to the BRICS summit in Johannesburg.

The U.S. dollar is involved in over 80 percent of international trade transactions. Recent geopolitical shifts and tensions between the West, Russia, and China have led to calls for diversifying away from the dollar.

Western sanctions on Russia and restrictions on technology exports to China have strengthened the resolve of developing nations to explore alternative currencies and multilateral clearance systems.

Shirley Ze Yu, a senior visiting fellow at the London School of Economics, highlights the economic motivations behind the move. As the U.S. Federal Reserve raises interest rates, developing countries face challenges with higher interest payments on dollar-denominated debt, prompting a shift toward borrowing in local or alternative currencies.

Gustavo de Carvalho, a policy analyst on Russia-Africa ties, emphasizes that the push for alternatives is driven by practical considerations.

Developing nations are increasingly wary of the risks associated with engaging with a single currency that may be weaponized for political purposes, as seen with recent sanctions.

While BRICS explores options such as a basket of currencies, a gold-backed currency or even cryptocurrencies, experts like Chris Weafer and Danny Bradlow express skepticism about the feasibility and potential risks of creating a unified BRICS currency.

Establishing common standards and underpinning values present challenges, making the creation of a unified currency complex. Anil Sooklal, South Africa’s BRICS ambassador, clarified that the goal is not to replace the dollar but to provide more global choices.

The focus is on promoting multipolarity and creating a financial world not dominated by one or a few currencies. Local currencies, such as the South African rand, Russian ruble or Chinese yuan, are likely to play a key role in this shift, with increased settlement already observed within the BRICS nations.

Analysts recognize, however, that the U.S. dollar’s dominance will probably continue for the foreseeable future.

Watch this video about Egypt ditching the U.S. dollar.

This video from the channel The Resistance 1776 on Brighteon.com.

More related stories:

Russian central bank governor claims BRICS group has now surpassed G7 in aggregate GDP.

Sources include:

Submit a correction >>

Tagged Under:

big government, BRICS, bubble, China, conspiracy, currency clash, currency crash, currency reset, dedollarization, dollar demise, EAEU, economic riot, Egypt, finance riot, market crash, money supply, risk, Russia, U.S. dollar, Us Dollar

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2021 DollarDemise.com

All content posted on this site is protected under Free Speech. DollarDemise.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. DollarDemise.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.